Simple steps to ensure your Affirm marketing is compliant with federal financial regulations

To get the full advantage of Affirm, letting your customers know about it is essential. But depending on how you market Affirm, you may need to include a disclosure based on federal financial regulations. Below, we'll take you through when that disclosure is needed, where it should go, and what it should say.

When you DON’T need a Truth In Lending Act (TILA) disclosure

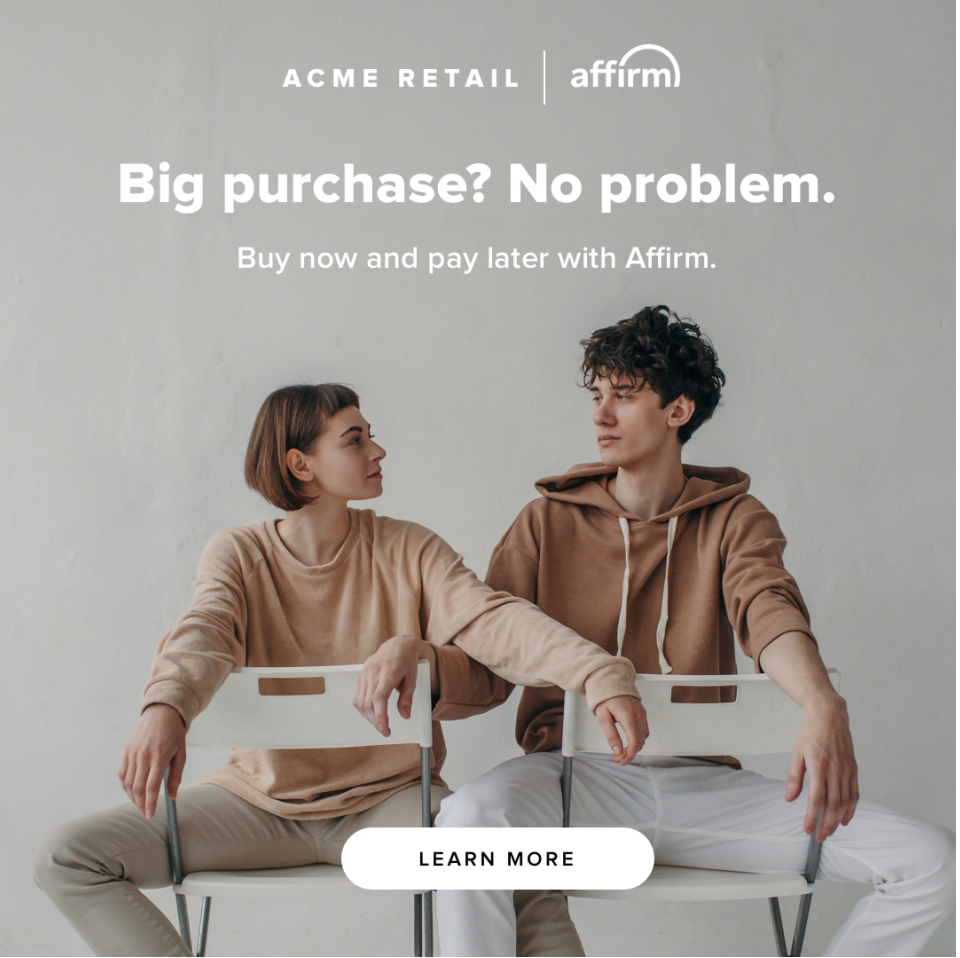

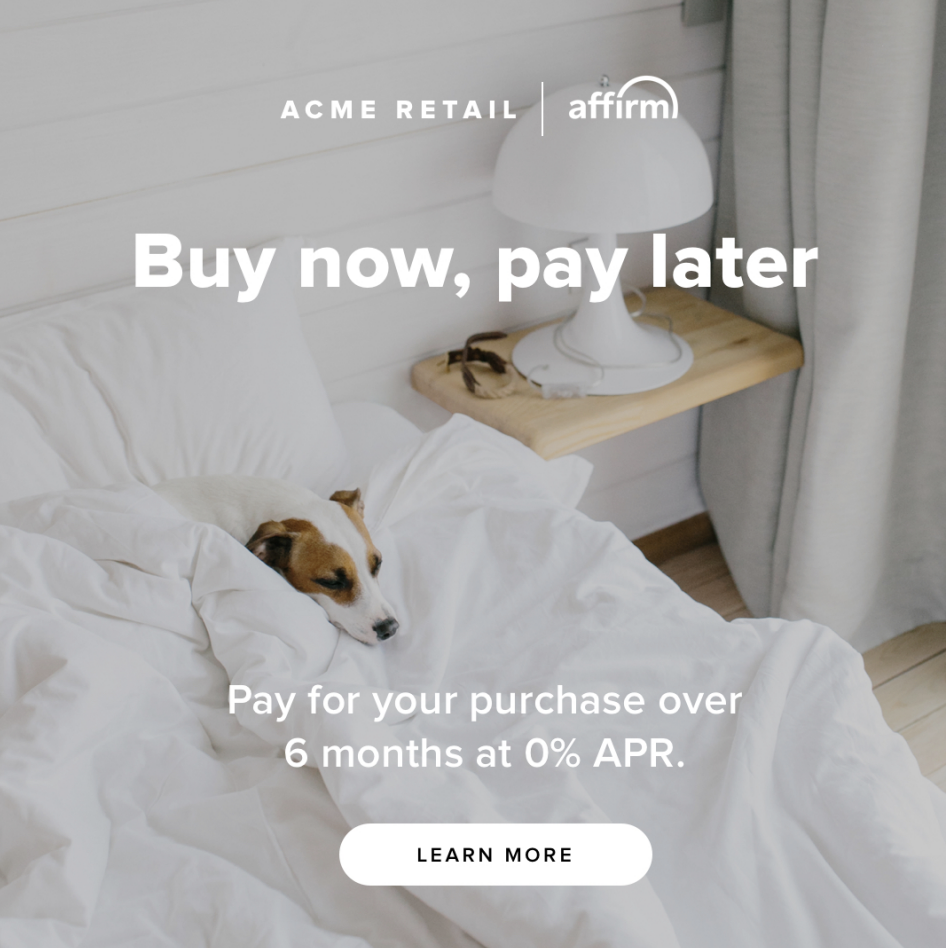

You can mention the following without including a disclosure:

Affirm

Monthly payments

Pay over time

Buy now, pay later

Financing

0% APR

10-30% APR

When you DO need a TILA disclosure

You do need to include a disclosure when you mention one or more of the following ‘trigger’ terms:

Number of payments (e.g. 6 payments)

Period of repayment (e.g. 6 months)

Monthly payment amount (e.g. $60/mo)

Existence of a down payment

Ready to try the buy now, pay later solution that delivers?

What goes into the disclosure?

The disclosure needs to include:

Purchase price/loan amount

Monthly payment amount

Length of loan term

APR

Potential for down payment

Any other restrictions (e.g., limited time, promo codes not valid with Affirm)

Example TILA Disclosure:

“$995 Acme purchase as low as $83.34/mo over 12 months at 0% APR. A down payment may be required. [Offer expires mm/dd/yy.]”

Note: In your disclosure, you should always use the APR that appears in the Affirm modal on your site.

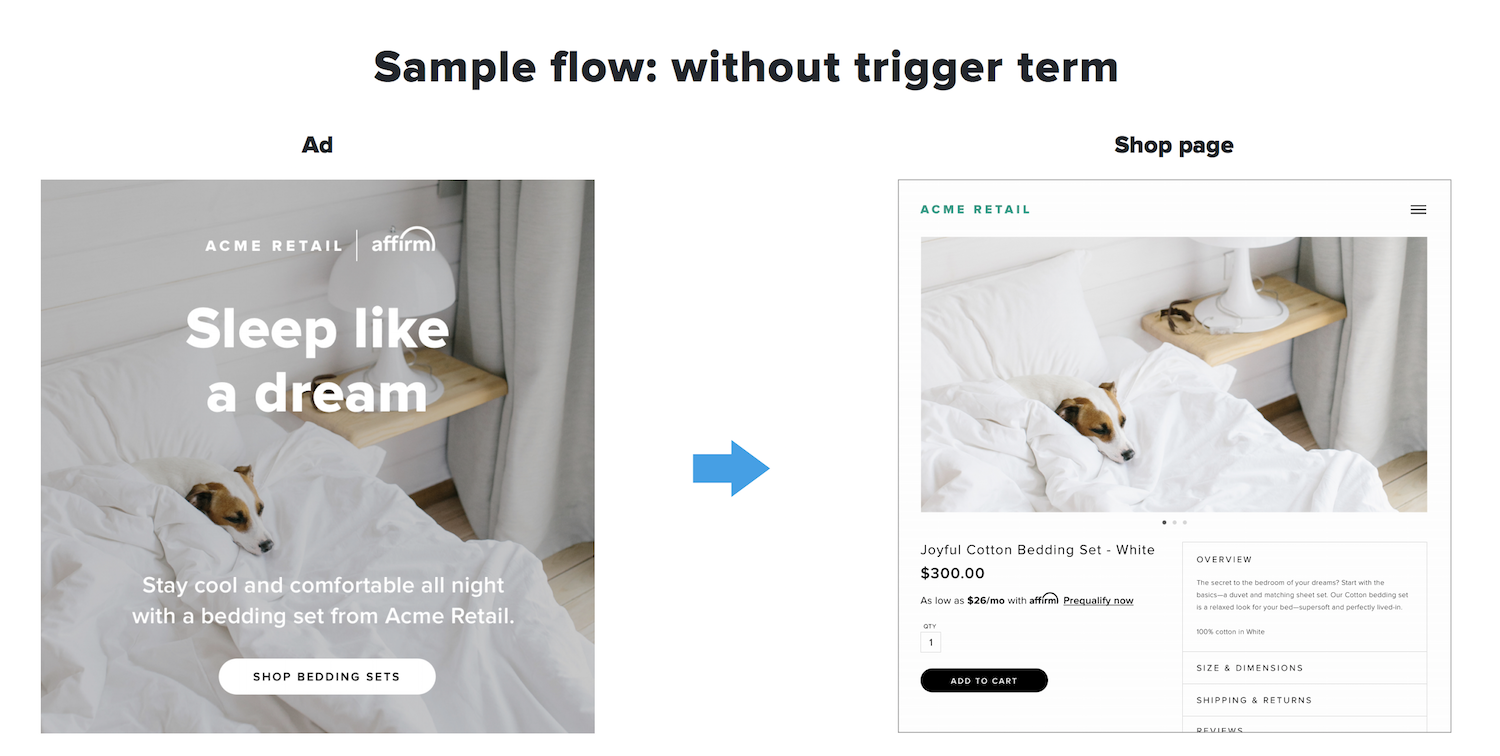

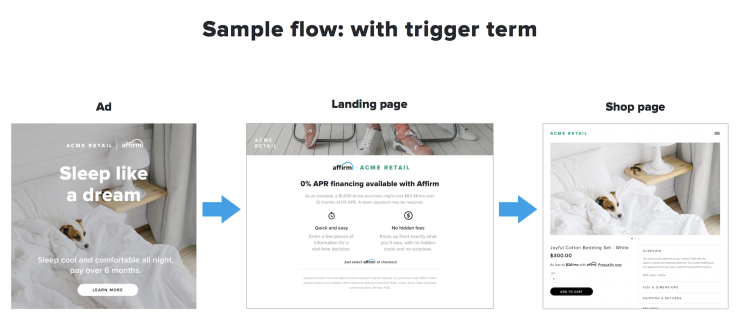

Where does the disclosure go?

Ideally, the disclosure should go on the same creative as the trigger term—in close proximity, and in a similar font size.

If there isn’t room for the disclosure on the creative, you can include a clear “Learn more” link to a landing page that shows the disclosure and also includes Affirm’s universal disclosure, shown below, in the footer.

The landing page can be either:

A) A product detail page with the Affirm educational modal preloaded (or with the disclosure prominently visible).

OR

B) An Affirm landing page on your site, example below.

Special guidance for email marketing

If the subject line has a trigger term, a disclosure needs to be visible in the body of the email.

If the body of the email has a trigger term, a disclosure needs to be clear and conspicuous and near the CTA

If the email links to a shop page, there’s an additional requirement: Affirm’s universal disclosure should be included in the email footer.

AFFIRM'S UNIVERSAL DISCLOSURE:"Subject to credit check and approval. Down payment may be required. For purchases under $100, limited payment options are available. Affirm loans are made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC."

Contact your client success manager or email merchanthelp@affirm.com if you have any questions.